Union Square

Description

Union Square remains San Francisco’s premier luxury shopping destination, featuring high-end brands like Breitling, Patek Philippe, Rolex, and A. Lange & Söhne alongside major national retailers such as Apple, Chanel, Hermès, and Nike. Despite its longstanding status, the area has faced challenges i

Join now to access the complete information.

street Details

Annual foot traffic

500,000 people/year

Daily vehicle traffic

15,000 vehicles/day

Population

25,000 people within

Day time population

35,000 people within

Household income (median)

$75,000.00 annually

Age (average)

> 35 years old within

Join now to access the complete information.

Sample Space 1

1000 SF

Suitable for retail, restaurant, office

Sample Space 2

1500 SF

Suitable for retail, restaurant, office

Sample Space 3

2000 SF

Suitable for retail, restaurant, office

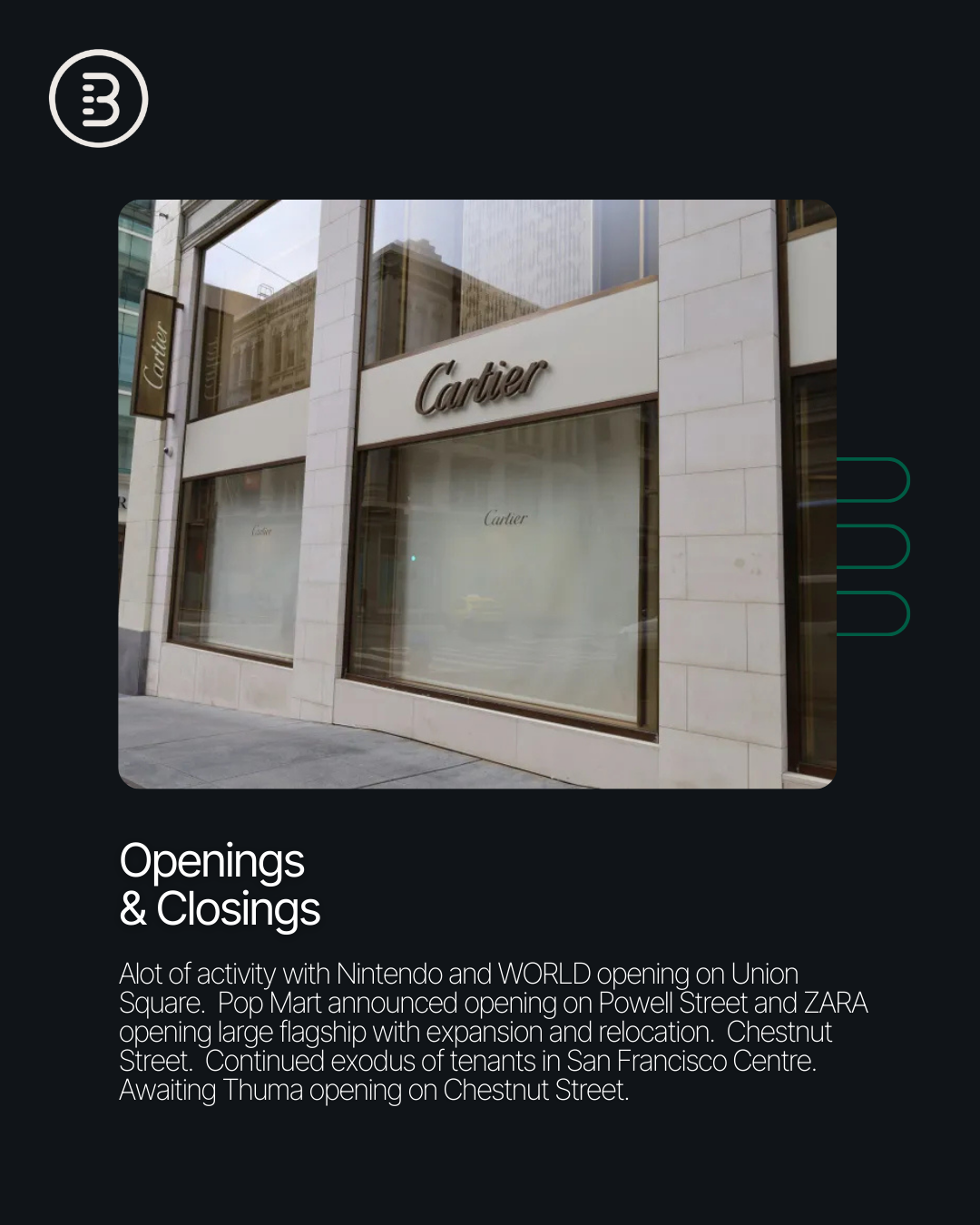

Local expert Kazuko Morgan reports a strong rebound in San Francisco and Union Square , where availability is tightening and tenant activity is surging.

Nintendo WORLD has opened on Union Square, Pop Mart is coming to Powell Street, and ZARA is expanding with a large flagship relocation. Thuma is also set to debut soon on Chestnut Street. Despite continued exits from San Francisco Centre, tenant reentry into Union Square is accelerating as fundamentals improve.

San Francisco leads the nation in return-to-office growth, up 40%+, fueled by AI companies taking significant space. Major events like Outside Lands, the Laver Cup, Super Bowl, and FIFA World Cup are boosting demand.

Downtown still offers attractive opportunities, but concessions are shrinking and many spaces are returning to multiple-offer situations.

Explore more: https://www.brandmarch.com/street/union-square

Nintendo San Francisco store to open in Union Square this year

Luxury Retail Returns: Kazuko Morgan on San Francisco’s Resurgence

Yadav Diamonds Opens in Union Square

Chanel to Begin Construction on San Francisco Flagship in Mid-2025

Join now to access the complete information.

Join now to access the complete information.

Local Expert Analysis

Retail Leasing and Market Dynamics

Despite its historical prominence, Union Square’s retail market has experienced turbulence, with vacancy rates now exceeding 20%. Several factors, including office space vacancies, a shift to online shopping, and high-profile store closures, have impacted leasing activity. However, new investments from retailers like Banana Republic and Ikea and public funding to improve the Powell Street Promenade are helping revitalize the area.

Union Square’s commercial rent levels remain some of the highest in San Francisco, with rates between $400 and $500 per square foot. The significant decline in office activity has affected foot traffic, but with the tourism sect